Wider health reach, innovative ingredients drive probiotic market

As research finds more connections between probiotics and various functions of the body, new ingredient variations sparks unique formulations.

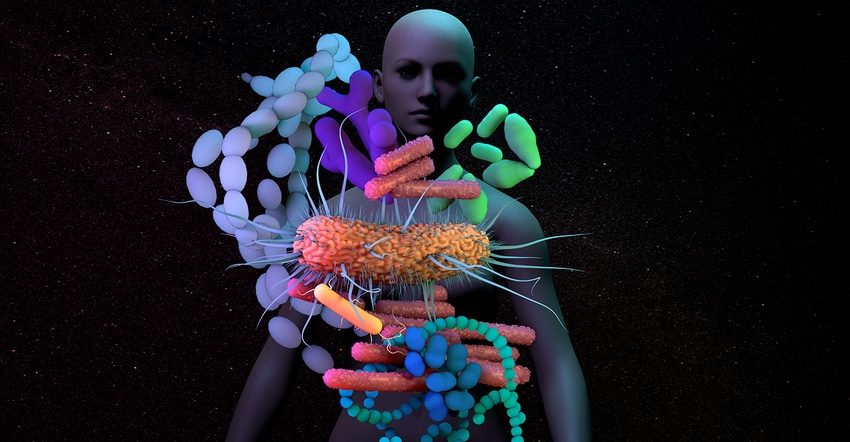

We are not alone. There is a universe of bacteria on and in the human body. Take it from someone who makes a living explaining vast numbers and forces in all of space and time. “More bacteria live and work in one linear centimeter of your lower colon than all the humans who have ever lived,” wrote the famous astrophysicist Neil deGrasse Tyson (Space Chronicles: Facing the Ultimate Frontier).

For fun, let’s fact check. The Population Reference Bureau estimates the number of people that have ever lived at around 108 billion (less than one-third of the number of hamburgers ever served by McDonald’s, but this isn’t an obesity article). There are about 100 trillion (1014) bacteria in the human colon (PLoS Biol. 2016;14(8):e1002533), which is about 150 cm long. This means about 667 billion bacteria reside in one linear cm of the human colon. Right again, Mr. Spaceman.

It makes sense then that the number of bacterial genes in this personal microbiome is 100 times more than in the human genome, and the Human Microbiome Project is investigating the relationship between these microbugs and their human hosts, including health and disease.

The point of this mathematical geek-out is bacteria are abundant not just in the gut, so it is only natural the market for managing microflora would expand beyond digestive health.

It’s always been a numbers game for bacteria, including the good bugs known as probiotics. Competition between good and bad in the gastrointestinal tract (GI) is often the first explanation consumers hear about probiotics and digestive health, the gateway to this world of beneficial bacterial health. Neither is a singularity.

In fact, it’s not even always just a quantity and competition thing. The GI tract has a close relationship to the immune system, and probiotics in this tract can augment immune function directly, by activating immune cells, and indirectly by supporting the gut’s epithelial barrier and innate mucosa. See page TK for more info.

Further, crosstalk between the nervous and digestive systems has given rise to the gut-brain axis of health, whereby scores of signaling cells are tied to both systems. Gut microflora appear to influence this axis by interacting with intestinal cells and the enteric nervous system, as well as by influencing hormones and neurotransmission via the endocrine system (Ann Gastroenterol. 2015;28(2):203-209). The end result and the focus of ongoing research is that gut microflora and probiotics may impact emotional and cognitive health including stress, anxiety and memory. See page TK for more info.

The growth of the probiotic market is not just biological but also generational.

In 2017, a Packaged Facts report noted 25% of U.S. adults seek foods and beverages with high probiotic content. The rush to food and beverage applications has been cited by numerous market research firms as a primary driver in the projected solid probiotic market growth of 12% to 13% in the U.S. and 7% to 8% globally, through 2027.

While older generations may use probiotics out of necessity, younger consumers are joining the beneficial bacteria game to foster a healthier lifestyle. A 2019 member-exclusive report from the International Probiotics Association (IPA), partnering with Euromonitor International, found 53 million adult U.S. consumers use probiotics, with Millennials the biggest share (44%), followed by Baby Boomers (31%) and Generation Xers (19%). Seniors were only 5% of this generational pie. It also noted probiotic users were more likely to be college grads and higher income earners.

As 24- to 39-year-olds, Millennials are a primary “new parent” generation, and their growing love of probiotics extends to their children. A recent Allied Market Research report predicted the U.S. infant and kids probiotic market would grow nearly 8% from $119.9 million in 2018 to $215.9 million in 2026 due to increased awareness of the digestive benefits in wee ones, including management of diarrhea, infant colic and allergies. The firm highlighted the rise in number of U.S. Millennial parents as a primary driver of this demand, “owing to their different approach to parenting than the previous generations.”

Splitting this younger population, the report pegged the kid segment as the barn burner with a 9.2% growth rate between 2019 and 2026. Online sales and e-commerce platforms are rapidly growing in both kids and infant probiotics categories due to convenience and the ability to more easily comparison shop. However, there is still some question in this market as to the effectiveness of probiotics in infants, which could hamper the category’s growth.

A recent report from the CBS program “60 Minutes” is not helping the awareness and perception of probiotic benefits in infants. The network’s chief medical correspondent, internist and gastroenterologist Jon LaPook, M.D., interviewed several doctors and researchers about the evidence on and value of probiotic supplementation in infants.

Frank Greer, M.D., a professor emeritus of pediatrics at the University of Wisconsin, replied researchers don’t really know how probiotics work and they shouldn’t be added to infant formula.

“The [FDA] does not classify probiotic capsules as drugs; this means they do not have to be proven safe and effective,” Greer said, concluding probiotics are not tightly regulated. “When added to anything, including infant formula, probiotics only need to meet a lower standard: generally recognized as safe [GRAS]."

IPA took issue with the report, calling the program unbalanced and full of misinformation that will only confuse the consumer more. IPA noted probiotics can fall under drug, supplement, food or medical food regulations depending on their intended use.

“The [FDA] has written and enforced regulations associated with the intended use,” the group explained in a statement, noting GRAS is the standard by which foods are regulated, and dietary supplements are regulated under the Dietary Supplement Health and Education Act (DSHEA). “Other countries such as Canada, Australia, Japan, South Korea or Brazil use different regulatory models with a different approach to premarket oversight for probiotic products. For probiotics to be featured on approved lists, most of these countries require manufacturers to submit data on GMP manufacturing, long-term ICH stability under standard ICH conditions, safety data and analyses for microbiological or chemical contaminants.”

As for evidence of effectiveness, IPA noted both the American Gastroenterology Association (AGA) and the World Gastroenterology Organisation (WGO) tout specific probiotics for infant diarrhea as well as for conditions such as irritable bowel syndrome (IBS) and allergy (Medicine. 2016;95(8):e2562).

Iva Hojsak, M.D., Ph.D., a pediatric gastroenterologist in Zagreb, Croatia, looked at the evidence for probiotic use in children and concluded there is evidence for specific strains on certain digestive ailments. “Based on currently available evidence certain probiotic strains (Lactobacillus rhamnosus GG [LGG] and Saccharomyces boulardii) have proven effect in the treatment of acute gastroenteritis and prevention of antibiotic associated diarrhea,” she wrote. “Furthermore, LGG was proven to be effective in prevention of nosocomial diarrhea and respiratory tract infection in day care centers.”

IPA dismissed the “60 Minutes” guest’s claims that positive results could be due to a placebo effect, reminding randomization and blinding are scientific standards that differentiate between actual and placebo results.

As for safety concerns about probiotics added to infant formula, IPA noted the European Society for Paediatric Gastroenterology Hepatology and Nutrition (ESPGHAN) concluded in 2011 that there were no safety concerns in these populations. IPA further emphasized the difficulty in studying clinical effects of supplements or any treatments in healthy populations, such as those who ingest infant formula.

“One can discuss what long-term is, but the IPA would like to remind the reader that there are several longitudinal studies that have followed children from birth for 11 years or more and cancer patients for more than 20 years; none of which have raised safety concerns over these extensive periods.”

Allied Market Research cited research evidence as a boon to the infant and children’s market, highlighting probiotic impact on bacterial and viral infections. IPA posted an article by registered dietician and author Clare Fleishman detailing the science of microbes in the respiratory system and what influence probiotics might have on upper respiratory tract infections (URTIs), but not necessarily the SARS-CoV-2 virus behind COVID-19.

Of course, supplement and food companies cannot make any direct or implied claims for any URTI or COVID benefits, but the firm reported consumers have increased purchasing of probiotics anyway, especially during the COVID-19 pandemic.

In a mid-pandemic webinar hosted by Natural Products Insider and the Council for Responsible Nutrition (CRN), Kristin Hornberger, principal, healthcare at IRI, included probiotics among the immune ingredients seeing a sales lift during lockdowns. She said U.S. multi-outlet (MULO) sales of probiotics increased $5.7 million during the “peak week” ending March 15, 2020.

In its annual Supplement Business Report, Nutrition Business Journal (NBJ) stated the pandemic bump helped rejuvenate a slowing probiotic supplement market. The publication projected an increase of 9.3% in 2020, up from 3.8% in 2019.

Allied Market Research cautioned the challenge to a continued COVID sales boost may be the periods of manufacturing closures and supply chain disruptions.

Whether it’s the pandemic or just the increased awareness of probiotic possibilities, consumers are buying into probiotics. CRN has reported consumer use of probiotics rose 5% from 2015 to 2019 (Consumer Survey on Dietary Supplements – 2015 to 2019).

From its Euromonitor report, IPA shared information with SupplySide West 2019 participants showing impressive 2018-to-2023 double-digit growth for probiotic supplements (26%) topping out at an estimated $5.6 billion in global sales in 2023. The growth for probiotic yogurt (21%) is expected to be similarly impressive and should see this leading probiotic product category reach global sales of $31 billion after the same five years.

Probiotics are not surging alone. These beneficial bugs are more commonly paired with prebiotics, which can serve as bacteria food. Together these ingredients are called synbiotics.

Market analysts at Grand View Research put 2019 global synbiotics sales at $700.6 million and predicted a growth rate of 8.3% through 2027 to reach $1.3 billion. Their report credited increasing consumption of functional food and beverages around the world as the main factor in this growth, adding increased awareness regarding health benefits in India, China and Japan is expected to provide near-future growth opportunity.

One innovative synbiotic pairing is with a prebiotic found naturally in human breast milk. University of California, Davis, researchers discovered early probiotic colonization of infant digestive systems requires the right probiotic strains and the right feed. Published online in Microbiome Journal, their work revealed select species of bifidobacteria supplied by breast milk can feed on key human milk oligosaccharides (HMOs), especially 2’-fucosyllactose (2’-FL), to more quickly establish a useful gut microbiome. They explained mothers secrete specific genes that promote development of various HMOs. The differences in HMOs secreted led to different rates and types of microflora development in the baby.

According to DuPont Health and Nutrition, HMOs are the third-most abundant compound in breast milk, behind lactose and fats. The company explained these prebiotics are not digested in the baby’s GI system but feed probiotic growth in the large intestines and promote long lasting immune, digestive and cognitive benefits.

DuPont explained about 130 HMOs have been identified in human breast milk, and 2’-FL is the most abundant, providing the basis of the company’s CARE4U prebiotic ingredient. A new study published online in Nature journal found the strain B. longum subsp. infantis Bi-26 uniquely utilizes the HMOs 2’-FL, 3’-FL and difucosyllactose (DFL) in quick fashion. The researchers noted, “Bi-26 grows faster, produces unique metabolites, and has a distinct global gene transcription response to FLs compared to the type strain [B. longum subsp. infantis ATCC 15697].”

In its Infant Formula Market Analysis, Coherent Market Insights highlighted a probiotic-HMO synbiotic, combined with A2 beta-casein protein, as one of the innovations launching from Gerber and representative of the efforts brands are undertaking to meet the rising demand for probiotic infant formula.

Pushing the innovation envelope further are postbiotics, also known as parabiotics. The World Health Organization (WHO) and Food and Agriculture Organization (FAO) agree the defining characteristic of a probiotic is its being a “live microorganism.” Postbiotics are dead probiotics.

Heat-killed probiotics are a consequence of high-temperature processing of products like some foods and beverages. There is some evidence heat-treated probiotics are as effective as live probiotics at boosting immune function and supporting gut health. See page 9 for more info.

Alone, in symbiosis with prebiotic feed or in the great beyond as dead postbiotics, probiotic ingredients are on the rise, thanks to increased awareness of their importance and benefits to health and the heightened self-care trend during the pandemic. Children’s nutrition and lifestyle products such as functional foods and beverages present white space opportunities for brands looking to expand.

Check out more in The probiotics era – digital magazine.

About the Author(s)

You May Also Like

.png?width=800&auto=webp&quality=80&disable=upscale)