Cognitive health: A lifelong opportunity

Most U.S. adults say healthy cognition is important, yet few are satisfied with their cognitive abilities, showing opportunity for natural product brands.

When considering various aging topics, such as overall physical health, retirement funds, health care expenses, sufficient energy and maintaining weight, one issue consistently ranks as the most important matter among American adults: mental/brain health.

Over the past 12 years, the importance of cognitive health has grown more than 20 percent (from 61 percent in 2005 to 74 percent in 2017) among all American consumers, according to data from the Natural Marketing Institute (NMI).

Cognitive Health a Lifelong Concern for Adults

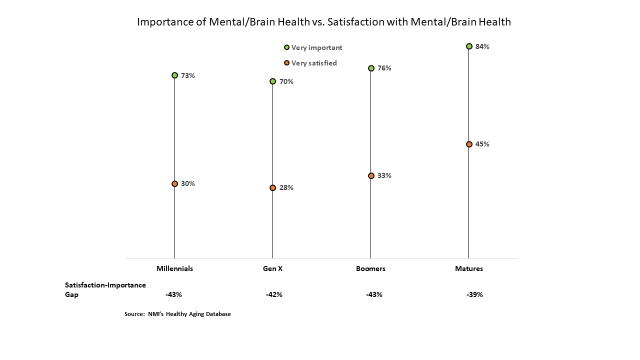

While conventional wisdom may hold that brain health is a concern reserved for later in life, NMI’s Healthy Aging Database® (HAD) revealed that recognizing the importance of cognitive health is not limited to older generations; in fact, cognitive health is important to all generations. While matures (aged 71 and older) place the highest level of importance on cognitive health (84 percent), millennials (ages 20 to 39)—even more so than Generation X (ages 40 to 51)—also exhibit high levels of concern (73 and 70 percent, respectively). And 66 percent of Boomers state that mental/brain health is a very important issue.

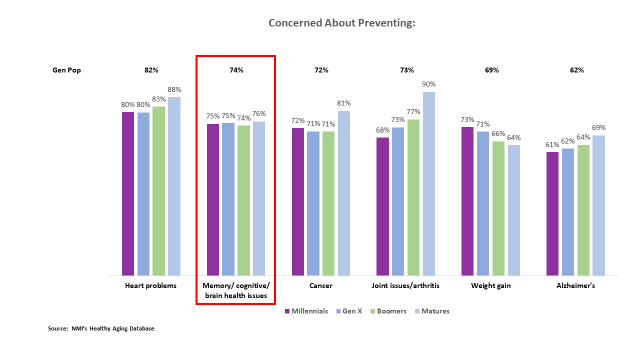

Put in perspective, cognition issues are the top concern among U.S. adults after heart problems. Concern over cognitive health in the general adult population is higher than concern over Alzheimer’s Disease. Whereas Alzheimer’s is generally accepted as a genetic disease primarily affecting seniors, cognitive health is perceived as lifelong health maintenance that has the potential to be maintained or improved.

With the proliferation of brain games, smart foods and cognitive dietary supplements available on the market, consumers have ample options from which to choose their personalized plan.

The Fear Factor

Just under half the American population (46 percent) fear losing mental/brain capacity as they age. The level of fear has remained relatively consistent during the past dozen years, suggesting that fear of losing cognitive capability is being more accepted (or just something that will have to be dealt with if an issue arises). Fear of cognitive decline increases with age, with 42 percent of millennials fearing such loss, compared to over half of Boomers and matures.

Triple Threat—the Relationship Between Cognitive Health, Stress and Anxiety

Management and treatment of memory, concentration and cognitive function remained stable over the past decade among most adults, however it is steadily increasing among millennials, up almost double from 2007 to 2017. Currently, millennials (7 percent) and Gen X (8 percent) report the highest levels of managing memory, concentration and cognitive functions, compared with fewer than 6 percent of Boomers reporting that they currently treat these cognitive functions. Not surprisingly, millennials and Gen X also claim to manage significantly more stress and anxiety than Boomers. According to NMI’s 2017 HAD, one-quarter of millennials and Gen X treat stress, compared to less than 13 percent of Boomers. Similarly, anxiety is treated by 27 percent of millennials and 22 percent of Gen X, significantly more than Boomers (12 percent). Could there be a link between stress, anxiety and cognitive health, especially among younger generations that may be feeling the pressure to prove themselves and/or perform in the workplace and among their peers?

Opportunities for Change, Disrupting Deterioration

Eight out of 10 adults feel they are taking more personal responsibility for their health now compared to 10 years ago. Of those, two-thirds agree one reason they are taking more responsibility is so they can be in their best mental health; Boomers (71 percent) and matures (73 percent) are only slightly more likely to agree than their younger counterparts.

Millennials and Gen X think proactively regardless of whether they act on their beliefs. Forty-one percent of millennials and Gen X are significantly more likely than other generations to strongly agree they desire a nutritional supplement or ingredient to keep memory and brain function healthy. Given that those under 40 are looking for solutions, this makes them a receptive target market for cognitive supplements or fortified food and beverage products. This compares to one-third of Boomers, suggesting either their lack of belief in supplement efficacy for cognitive health, or concern that it may be “too late” to effect a meaningful change.

Nearly three-fourths (74 percent) of U.S. adults feel mental/brain health is important. Compared to satisfaction levels, a wide gap is clear. On average, only one-third (32 percent) of adult consumers are very satisfied, creating unmet need states and respective opportunities across the supply chain.

Lack of satisfaction compared to perceived importance is consistent across all age groups. Millennials (43 percent difference), Gen X (42 percent), Boomers (43 percent) and matures (39 percent) all show large gaps between importance of and satisfaction with cognitive health. Based on these gaps, consumers may benefit from products and services geared toward mental performance at all stages of their adult lives. With the addition of their proactive beliefs, consumers under 40 are prime targets for many companies to provide new products and ways for consumers to maintain cognitive health and fight mental deterioration.

Cognition is clearly a lifelong challenge, which in turn creates opportunities for a health benefit platform with innovative solutions for all.

Steve French ([email protected]) is a managing partner at the Natural Marketing Institute (NMI). NMI is a strategic consulting, market research and business development firm specializing in the health, wellness and sustainability marketplace.

About the Author(s)

You May Also Like

.png?width=800&auto=webp&quality=80&disable=upscale)