Despite an increase in obesity, weight loss product sales are on the decline, challenging brand holders to shift their focus from restrictive dieting to active nutrition and satiety.

With concern about the long-term health and economic effects of being overweight and obese front-of-mind for consumers, as well as public and private health advocates, weight management products should be primed for explosive growth. However, evolving eating habits, tastes and consumer sentiments around healthy weight have taken a toll on the fortunes of many well-established category stalwarts. In the age of the hyper-informed but equally fickle consumer, fortunes will rest on how adeptly producers and marketers can formulate and communicate product benefits in authentic, relatable narratives.

Has “Diet" Become a Four-Letter Word?

Around the world, emerging and developed countries are struggling with their beltlines. In the United States, nearly 73 percent of the population was classified as overweight (body mass index of between 25 and 30 kg/sq m) or obese (body mass index of more than 30 kg/sq m) in 2015—a figure that grew from 64 percent in 2005. Excess weight is associated with a whole host of negative health outcomes, including higher incidences of diabetes, heart disease and cancer. In the United States, as in many other countries, obesity in particular is conspiring to drive up health care costs. According to research published by the University of Illinois in early 2015, obesity adds nearly US$1,400 to health care costs per person per year in the United States. Beyond basic health concerns, consumers, companies and governments alike are beginning to focus ever more closely on the potentially calamitous long-term economic effects of being overweight and obese.

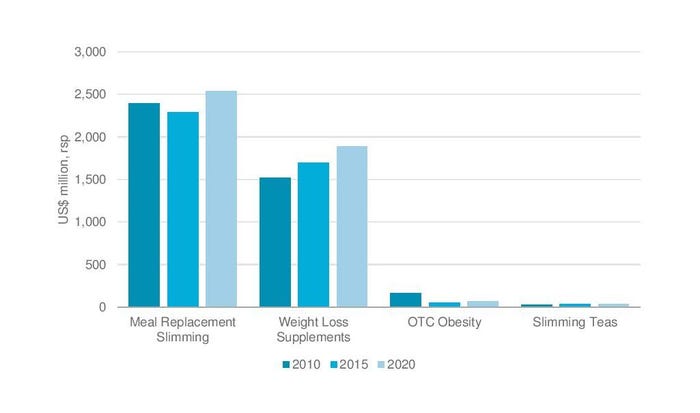

In a world fraught over waistlines, one might expect weight loss-positioned products to be growing at a speedy clip. However, according to Euromonitor International’s latest consumer health research, U.S. retail value sales of weight management products declined by 3 percent to $4.1 billion in 2015. A major driver of the category’s relatively poor performance of late (sales declined by 0.5 percent from 2010 to 2015) is an increasing shift in consumer sentiments around weight loss. More consumers are viewing healthy weight as a component of overall well-being. This has led to substantial category switching, with consumers seeking products promoted more directly around active nutrition and satiety, as opposed to those strictly tied to restrictive dieting. The trend extends beyond dietary supplements to the much larger packaged foods categories. From 2010 to 2015, retail value sales of U.S. packaged foods with a “reduced fat" positioning declined by 9 percent to $21.9 billion, compared to 2 percent growth toS$363.2 billion across the entire packaged foods industry.

With consumers increasingly ditching the restrictive, calorie-cutting weight loss mindset in favor of nutrition regimes that focus on balanced, nutrient-dense meals and healthier snacking, the term “diet" is quickly falling out of fashion. Major brands have shifted their advertising to more heavily focus on nutrition and satiety, while reintroducing their brands as part of a complete nutrition plan. Kellogg’s Special K, a brand long associated with its “lose two pants sizes in two weeks" challenge, underwent a branding reboot in 2014. Its subsequent promotions, including the 2015 “Eat special. Feel special." television ads, and the redesigned packaging of its meal replacement shakes, were aimed at helping the brand compete with newer competitors more focused on total wellness than dropping weight.

Ingredients May Offer More Sustainable Growth.

The weight management category has a long and dubious history of pump-and-dump advertising around new miracle ingredients. From effective yet deadly ephedra in the late 1990s to raspberry ketones in the 2010s, the landscape is littered with quick-fix ingredients, most of which just as quickly failed. While consumers remain susceptible to slickly marketed miracle solutions, the trend seems to be moving toward less bombastic, more scientifically bona fide ingredients. Recently, L-carnitine and conjugated linoleic acid (CLA) have found success, both as standalone products and in combinations.

However, the category’s future success would seem to be tied to two well-established dietary ingredients being refashioned as healthy weight superstars. Packing relatively low calorie counts, protein and fiber have become go-to weight management ingredients for producers. Their ability to boost satiety is becoming an increasingly valuable proposition, as consumers move from silver bullet weight loss cures toward more holistic weight management plans. The expansion of brands such as Metamucil (through its recently launched Meta Appetite Control product) and the spate of lean or diet whey products (largely from sports nutrition producers) are catering to the evolving understanding of protein and fiber from muscle and digestive health ingredients, respectively, to healthy weight aids.

Premium Options Should Reignite Sales

Meal replacement slimming products—weight management’s largest category—have long been associated with low-quality ingredients, artificial flavors and poor taste and mouthfeel. This lack of quality has contributed to low consumer retention. Most consumers have proven unwilling to stick with meal replacement slimming products for the long term, as many view them as more of a chore than an aid.

However, a growing number of both established and upstart meal replacement slimming companies have invested in improving the category’s reputation. Adopting trends from the health and wellness packaged foods industry, more brands are adopting exotic, gourmet flavors (including superfruits and ancient grains), free-from claims and all-natural formulations. High-growth brands such as ProBar Meal and Shakeology are opening the category to more discerning consumers through the use of whole food ingredients and a more neutral healthy weight positioning.

U.S. Sales of Weight Management Products, 2010-2020

As a senior consumer health analyst, Chris Schmidt ([email protected]) co-directs Euromonitor International’s global consumer health research. Focusing on competitive analysis, he is responsible for the production of Euromonitor’s company profiles and briefings on corporate strategy in the consumer health industry. Schmidt also serves as Euromonitor’s specialist in the vitamins and dietary supplements and sports nutrition categories.

Looking for more on weight loss ingredients and how to evaluate the science and claims? Join us for the Strategies for Successfully Navigating the Weight Management Market workshop on Wednesday, Oct. 5, at SupplySide West 2016.

About the Author(s)

You May Also Like

.png?width=800&auto=webp&quality=80&disable=upscale)