To expand beyond bodybuilders and elite athletes, sports protein bar manufacturers need to offer products that are just as tasty as they are functional.

For years, products in the sports nutrition protein bar and bar-format protein supplement categories were derided for substandard flavors and mouthfeel. Though supremely convenient, many consumers used the products begrudgingly and in spite of their lack of enjoyment. However, investments in production methods and a growing willingness to adopt formulation trends from the health and wellness packaged foods industry have reinvigorated protein bars, enticing legions of new consumers and plotting a roadmap for much-needed taste innovation in the sports nutrition and protein supplement categories.

Lagging under the Yoke of Bad Taste

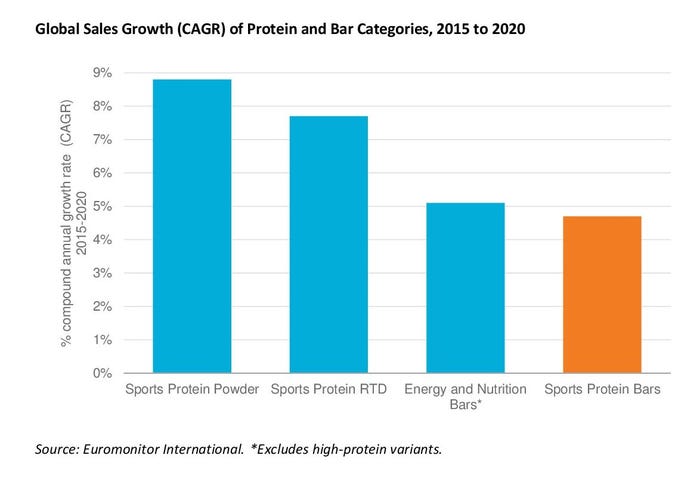

Though their global retail value sales grew at an enviable 7 percent annually from 2010 to 2015, sports protein bars were heavily reliant on a small handful of markets, with Australia and the United Kingdom contributing nearly half of all value sales growth. In the United States, the world’s largest sports protein bar market, sales growth has slowed substantially since 2012. A major force underlying the slowdown has been the category’s inability to match gains made by other sports nutrition categories among consumers beyond the traditional core demographic of bodybuilders and elite athletes. Taste concerns may have contributed substantially to the issues, as protein bars have long been associated with chalky, brick-like consistencies and artificial flavors.

The onslaught of new product launches in the parallel energy and nutrition bars category has been driven by premiumization that has largely remained absent in sports protein bars. Trending brands such as Kind and Quest Bar have developed loyal followings by pairing functional formulas with gourmet tastes and better mouthfeel that provide a premium snacking experience. Protein’s appeal to consumers is undeniable, but the category is likely to continue to underperform other sports protein formats if it is unable to provide more enjoyable products.

New Consumers Demand Sophisticated Products

Complacency in protein bar formulation can be seen as a product of demographics. For most of its existence, the sports nutrition category has catered to a core demographic of body builders and elite athletes. Functionality is king for these consumers, many of whom are happy to suffer through uninspired flavors and unappealing mouthfeel for high protein contents and ideal macronutrient balance.

However, the sports nutrition demographic base is undergoing a substantial expansion. In addition to casual users—so-called “weekend warriors" looking to protein products to supplement active lifestyles or as a healthier alternative to junk food offerings like candy bars—a growing cohort of consumers are willing to spend lavishly on products and services that help them achieve their fitness-oriented lifestyles. Most prominent in developed sports nutrition markets like the United States and Australia, these mainly young, affluent consumers are investing heavily in fitness as a fundamental aspect of a health-focused, high-performance lifestyle, as evidenced by the explosive growth of high-priced fitness programs. While they have high demands for functionality, fitness lifestyle users have proven less willing to sacrifice taste—or the product integrity claims such as organic, all natural, sustainable and non-GMO (genetically modified organism)—that they demand from their standard foods. With few sports protein bars passing muster, these consumers seem to be opting for other products. This has been a boon to categories like energy and nutrition bars. Despite being nearly four times as large as the sports protein bar category, energy and nutrition bars actually grew faster from 2010 to 2015 with sales increasing 65 percent to US$3.4 billion. Unlike sports protein bars, the category has been quick to cater to evolving taste trends, such as the exotic super fruits in ProBar’s Superfruit Slam, ancient grains in 22 Days’ Quinoa Chocolate Chip Crisp and savory flavors from brands like Mediterra Nutrition or Journey Bar. The trend can also be seen in the rapid rise of value-added or premium versions of meat snacks like beef jerky. Brands like Krave—which targets younger, active consumers looking for premium high-protein products through sampling at marathons and was purchased in 2015 by Hershey for $220 million—have paved the way for the spate of recent premium meat bars such as Epic in the United States or Ochsenriegel in Germany.

The distinguishing characteristics behind these sports protein bar alternatives is a greater willingness to meet increasingly sophisticated consumer tastes. More chef-driven flavors—including exotic or savory flavors—and whole foods ingredients—like nuts—can boost a bar’s profile and shift consumer sentiments around the products from purely functional to guilt-free indulgence. This can boost brand loyalty while increasing the relevant usage occasions. Unfortunately, this sort of forward-thinking formulation experimentation has largely been absent in the sports protein bar category.

While the organoleptic limitations of producing high-protein bars are a limiting factor, sports nutrition brands in the bar category can and should do more to increase the relative attractiveness of their products. To do this, the category will need to look beyond itself to more innovative food categories—including premium confectionery and savory health and wellness snacks—to find inspiration for products that can fulfil both functionality and flavor demands. If it does not, customers will vote with their dollars, opting for other, more inventive categories, thus depressing future category growth and leaving a doorway to greater exposure for the sports nutrition category as a whole unopened.

Chris Schmidt ([email protected]) is a senior consumer health analyst at Euromonitor International (euromonitor.com).

About the Author(s)

You May Also Like

.png?width=800&auto=webp&quality=80&disable=upscale)