According to a new report from Packaged Facts, 50 percent of pet product purchasers agree that natural and organic pet foods are safer than regular pet foods. Data also revealed that 64 percent of dog owners and 56 percent of cat owners consider product safety and the potential for contamination when purchasing pet food.

Pet food spending globally represents a roughly US$70 billion industry, with nearly two-thirds of sales taking place in the United States and Europe, according to a recent GfK analysis. What’s more, the natural trend in pet food is almost exclusively a U.S. phenomenon with natural SKUs accounting for 69 percent of all dollar sales in its pet retail channel.

Natural and organic products benefit from the consumer perception, whether real or imagined, that they are purer and safer than regular products. According to a new report from Packaged Facts, 50 percent of pet product purchasers agree that natural and organic pet foods are safer than regular pet foods. Data also revealed that 64 percent of dog owners and 56 percent of cat owners consider product safety and the potential for contamination when purchasing pet food.

“The widespread pet food recalls of Spring 2007 thrust the issue of pet food safety into the spotlight," said David Sprinkle, research director, Packaged Facts. “Additionally, food recalls and pathogen outbreaks in the human food markets have left consumers leery of trusting the safety of the food products they are purchasing and caused them to question not just what they themselves are consuming, but their pets as well."

In the decade following the 2007 pet food recalls, dozens—if not hundreds—of smaller-scale recalls have taken place in the pet food market. All have been regulated by the Food Safety Modernization Act (FSMA), which allows FDA to implement mandatory recall proceedings under the Food and Drug Administration Amendments Act (FDAAA). Also involved is the new Web Portal Registry launched in 2010 by the FDA and the National Institutes of Health (NIH), which allows veterinarians, pet owners, and manufacturers to report safety concerns associated with pet foods and veterinary drugs. On the non-food side, the safety issue resonates especially for ingestible products like supplements and chews, but it is also a growing factor in other areas.

Beyond lingering pet owner concern over product safety, the “Natural, Organic and Eco-Friendly Pet Products in the U.S., 6th Edition" report identified three key trends that are shaping and growing the market for natural, organic and eco-friendly pet products:

Grain-Free Pet Food Proves More Than a Passing Trend. As of 2016, the grain-free movement has become such a large part of the pet food market that what began as a natural product phenomenon has crossed the boundaries into more conventional products. At the same time, the trend has become firmly entrenched as a crucial part of natural pet food market positioning. Packaged Facts’ pet owner survey reveals that 19 percent of dog owners and 15 percent of cat owners were using grain-free pet foods—percentages that will only continue to swell.

Increased Transparency Crossing Over From Human Market. The combination of consumer interest in the nutritional quality and safety of the pet foods and supplies they purchase has driven a demand for increased transparency in the contents and composition of products in the pet market. Mirroring trends in consumer packaged goods across the United States, the more consumers educate themselves about the potential hazards that exist in the products they purchase, the more they desire to know exactly what it is that they are putting in, or on, their pets’ bodies, and are thus demanding labels that accurately reflect the contents of the product.

Availability of Grass-Fed and Free-Range Protein Sources. Like so many other human food trends, the appeal of meat protein that is ethically and sustainably sourced has crossed over into the pet food market. While the expense of grass-fed and free-range foods for pets may be off-putting, pet owners committed to both high quality foods and ethical food production see grass-fed and free-range proteins as worth the cost.

These trends were found in many of the SupplySide CPG Editor's Choice Awards submissions in the Pet Food and Pet/Animal Supplements categories. (Click on the links to see the finalists in each category.) The pet food sector has been keeping up with consumer demand for clean-label options that are free from certain ingredients such as artificial colors or flavors, grains, gluten or corn. However, the pet/animal supplement sector is poised for huge growth on a global scale as more consumers seek out products positioned toward digestive, immune and joint health.

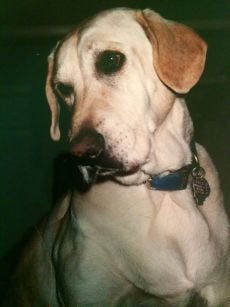

Animals can face aches and pains, much like humans, but there are a host of natural ingredients that can help increase joint strength and reduce symptoms related to joint health disorders in animals. Sadly, I know this first-hand. Our first Labrador retriever, Barney, suffered from debilitating hip dysplasia from the time he was 2 years old. In addition to slimming him down, he was treated with monthly Adequan injections and put on a daily dose of glucosamine. He lived a long and happy life, crossing the Rainbow Bridge not long after his 11th birthday.

That was 16 years ago, and science has come a long way since then. In fact, joint/mobility products in pet specialty grossed $US95.7 million in 2015, up 45 percent from 2011, and dog products represent 99 percent of joint/mobility dollar sales in the pet specialty sector. Download INSIDER’s Animal Joint Nutrition Digital Magazine to find out more about the latest research, ingredient trends and formulation considerations for developing effective animal joint health products.

Check out the world's best Labby. Our boy was a handsome man!

About the Author(s)

You May Also Like

.png?width=800&auto=webp&quality=80&disable=upscale)