September 27, 2011

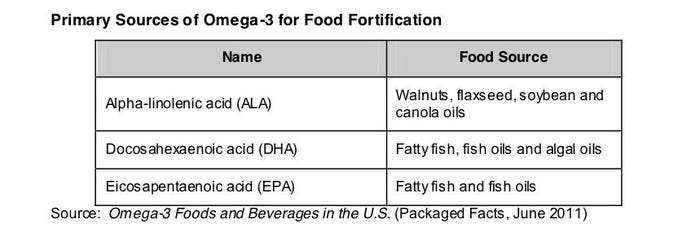

The three omega-3 fatty acids commonly recognized in the scientific literature as having health benefits are docosahexaenoic acid (DHA), eicosapentaenoic acid (EPA) and, to a lesser extent, alpha linolenic acid (ALA). DHA and EPA are derived from marine sources, while ALA is derived mostly from plants.

Deficiency or imbalance in essential fatty acid (EFA) consumption, particularly omega-3 deficiency, is common in the United States. This deficiency is tied to various ailments and diseases, because EFAs support the cardiovascular, reproductive, immune and nervous systems. EFAs are also needed for proper growth in fetuses, infants and children, particularly for neural development and maturation of sensory systems.

Moreover, omega-3 fatty acids are constantly being used by body cells and must be replaced. While its possible to consume toxic amounts of certain vitamins, such as vitamin A, its difficult to consume too much omega-3, even if one eats fish frequently and takes an omega-3 supplement.

Fish oils, the main sources of long-chain omega-3 fatty acids, are primarily consumed as dietary supplements, and usage rates for fish oil supplements have reached new highs. According to Experian Simmons national consumer survey data, the percentage of U.S. adults who use any type of nutritional supplements edged up only slightly from 56 percent in 2006 to 57 percent in 2011. Usage rates for fish oil supplements, in contrast, jumped from less than 9 percent in 2006 to 17 percent in 2011, such that more than 38 million U.S. adults are now buying these products.

Even so, the critical nutritional importance of omega-3s, the bodys need for a steady supply and the low risk of overdosing or side effects combine to make omega-3 a prime candidate for food fortification. As technology allowed for different formulations, marketers began to add fish oils to different types of foods, beginning with spreads and oils, and continuing into dairy products, cereals and even fruit-flavored beverages. The primary obstacles to unlimited introduction of omega fatty acids into all types of foods and beverages were issues of taste, smell, oxidation and cost. Fish oils and powders have had to battle with consumer perception of unappetizing taste or smell, even though these concerns have largely been resolved.

Data from Product Launch Analytics, a Datamonitor service, indicated 12.9 percent of the new food and beverage products introduced to the U.S. market between 2005 and 2010 had claims related to high-omega-3 or high-DHA nutritional content. Excluding fish, the leading categories for high omega-3 positioning were cereal bars, breakfast cereals and functional drinks, followed by baby snacks, other savory snacks, breads and rolls, and milk/cream products. Although growth rates in retail sales of omega-3 food and beverage products have slowed in the United States from pre-recession era peaks, the market will increase by 11 percent in 2011 to reach $4.4 billion, according to Packaged Facts estimates.

The high level of consumer demand for omega-3 products plays out every day in food retailers. Packaged Facts Food Shopper Insights survey of U.S. consumers who had been grocery shopping within the last 24 hours showed that 9 percent had purchased food products making a high omega-3 claim. Among those who consider natural and organic foods to be most important to their decision about where to shop for groceries, that rate jumps to 21 percent.

The omega-3 product market is not just limited to foods and beverages or just to U.S. shoppers, of course. Within the U.S. market, more than one-third of the new product introductions that bear high omega-3 product claims are for non-foods, primarily in the skincare or pet food categories. And while the United States remains unchallenged as the global leader in new products making high omega-3 content claims, the rest of the world now accounts for half of such introductions. Growth rates in omega-3 food and beverage products remain robust in the United States, and the market has grown as wide as the seas.

David Sprinkle is the publisher and research director for Packaged Facts , Rockville, MD, a division of MarketResearch.com. He has presented at conferences including Fancy Food Show, Focus on the Future, the National Confectioners Association, SupplySide West and Tea Expo East, as well as contributing to trade publications such as Candy & Snack Today, Gourmet Retailer, Natural Products INSIDER and Progressive Grocer. His study on Premium Consumers and the New Economy: Food and Foodservice was published by Packaged Facts in 2009. He has a Masters of Business Administration from Tulane University, New Orleans, where he also taught courses in business communications.

About the Author(s)

You May Also Like

.png?width=800&auto=webp&quality=80&disable=upscale)